Executive Overview: Commissions Are the Symptom — Dependence Is the Disease

In luxury hospitality, OTA commissions are often framed as a percentage problem: 15 percent, 20 percent, sometimes more. But commissions are merely the visible cost. The more consequential issue is dependence — the structural reliance on third-party platforms to generate demand, control guest relationships, and influence booking behavior.

When OTAs move from supplemental acquisition channels into primary demand drivers, luxury properties quietly surrender pricing power, guest data ownership, and long-term margin control. Reducing OTA dependence is not about eliminating OTAs altogether. It is about restoring balance and ensuring that direct, high-margin channels perform the role they were designed to play.

This balance is governed by a broader strategic system, outlined in our luxury hospitality marketing strategy, which defines how luxury brands create demand, protect margins, and shift bookings toward owned channels.

Why OTA Dependence Is Uniquely Costly for Luxury Properties

Luxury hotels operate under a fundamentally different economic and brand model than mid-scale or commoditized lodging. Three factors make OTA dependence especially damaging at the high end.

First, contribution margin sensitivity. Luxury properties carry higher fixed costs and elevated service expectations. Every incremental percentage point paid to an intermediary has an outsized impact on net contribution.

Second, brand dilution through comparison shopping. OTAs reduce differentiated luxury experiences to price, photos, and reviews, undermining the value created by strong luxury hotel marketing strategies.

Third, erosion of pricing power. Rate parity restricts a hotel’s ability to meaningfully incentivize direct bookings, often forcing properties to pay commissions simply to access guests who already intend to stay.

In effect, OTAs monetize demand that luxury brands themselves create.

What OTA Dependence Really Costs a 200-Room Luxury Hotel

For many luxury hotel owners, OTA commissions are viewed as a necessary cost of distribution. In reality, they represent one of the largest and most persistent sources of margin leakage on the property P&L.

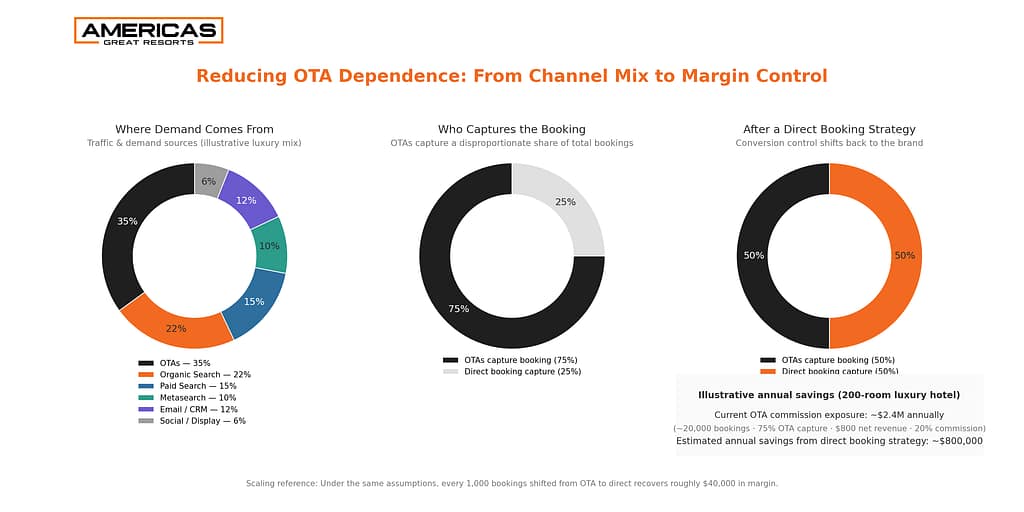

Consider a realistic 200-room luxury hotel operating at healthy occupancy with approximately 20,000 bookings per year. At an average net room revenue of $800 per stay and a 20 percent OTA commission, a property where OTAs capture roughly 75 percent of bookings is exposed to approximately $2.4 million in annual commission expense.

For context, every 1,000 bookings shifted from OTA to direct recovers approximately $40,000 in margin under the same assumptions.

Here is the critical insight most owners miss: reducing OTA capture does not require eliminating OTAs or sacrificing demand. It simply requires shifting control at the point of conversion. Reducing OTA share from roughly 75 percent to 50 percent — by strengthening direct booking performance — recovers approximately $800,000 in margin annually under the same operating conditions.

This is not a marketing optimization. It is a structural improvement to profitability — achieved without adding rooms, increasing rates, or expanding paid media spend.

A Simple Diagnostic: How Dependent Is Your Property on OTAs?

Owners and asset managers can quickly assess whether OTA dependence has become structural by reviewing a few indicators:

- More than 40–50 percent of first-time guests originate from OTAs

- Brand search traffic disproportionately converts on OTA listings rather than the brand website

- Email capture rates at booking or post-stay are limited

- Repeat bookings through owned channels remain low

- Direct booking share is flat or declining year over year despite stable demand

If two or more of these conditions apply, the issue is not commission negotiation — it is distribution strategy.

OTAs as Paid Acquisition Channels, Not Strategic Partners

OTAs serve a legitimate role as paid acquisition platforms. They aggregate demand, provide visibility in competitive markets, and help fill need periods. What they cannot do is build long-term brand equity or guest relationships on your behalf.

OTAs do not create loyalty to your property, provide full access to guest behavior, or support lifecycle marketing beyond a single transaction. Treating OTAs as strategic partners rather than acquisition channels leads to overreliance and weakens long-term control over demand.

Why Discounting Fails in Luxury Hospitality

When commission pressure increases, many properties attempt to reclaim bookings through discounts or superficial value-adds. In luxury hospitality, this approach consistently underperforms.

Luxury guests are rarely motivated by marginal price differences. They respond to recognition, personalization, exclusivity, and experiences unavailable through third-party platforms. Discounting conditions guests to shop harder, wait longer, and devalue the brand while attracting price-sensitive travelers who are less likely to return.

Reducing OTA dependence requires experience-led differentiation — not rate erosion.

How can luxury hotels reduce OTA dependence without discounting?

Luxury hotels reduce OTA dependence by shifting demand control back to owned channels — not by competing on price.

Discounting is structurally weak in luxury because it attracts the wrong buyer behavior and trains guests to shop harder on intermediaries. The durable alternative is an owned-channel strategy that captures guest data, converts through direct booking paths, and compounds revenue through lifecycle email and retention — reducing margin leakage and restoring pricing power over time.

The Three-Channel Model for Reducing OTA Dependence

Sustainable distribution balance is built on three distinct channel types.

Owned Channels: The Foundation

Your website, CRM, and email list form the economic backbone of direct bookings. This is where margins are protected and guest data is owned. Strong performance here depends on conversion optimization, brand storytelling, and disciplined direct-channel strategy.

Intercept Channels: Strategic Defense

OTAs, metasearch, and paid media intercept demand when guests are actively shopping. These channels should be managed intentionally and measured strictly as acquisition costs — not relied upon for long-term growth.

Relationship Channels: Compounding Growth

Email is the most powerful relationship channel because it enables permission-based communication across the entire guest lifecycle. When executed correctly, hotel email marketing strategies designed to drive direct revenue become a compounding asset rather than a promotional expense.

To explore how strategic email marketing drives long-term direct bookings, see our comprehensive guide on Email Marketing for Hotels, which breaks down segmentation, automation, lifecycle workflows, and the economics of guest retention.

Email as the Compounding Engine of Direct Revenue

Email delivers its highest ROI when engineered as a lifecycle system. Pre-stay communication builds anticipation and upsell opportunities. On-property messaging enhances the guest experience. Post-stay engagement drives retention and referrals. Win-back campaigns reactivate high-value past guests.

Unlike paid acquisition, email performance improves over time. Each stay strengthens future revenue potential without incremental commission costs.

Why Most Hotel Email Programs Fail to Reduce OTA Dependence

Most hotel email programs underperform because they are confined to existing CRM lists and generic batch campaigns. Common limitations include limited segmentation, inconsistent cadence, and no acquisition strategy to grow the list beyond past guests.

Without lifecycle structure and behavioral targeting, email becomes a maintenance tool rather than a growth engine. A deeper explanation of this failure point is outlined in how luxury resorts reduce OTA dependence with email marketing through lifecycle-driven direct booking strategy.

A Quantified Illustration: The Economics of Shifting the Mix

The economics behind reducing OTA dependence scale directly with booking volume. While the financial impact is most visible at the property level, the underlying math remains consistent regardless of size.

Under the same assumptions outlined above, every 1,000 bookings shifted from OTA to direct channels recovers approximately $40,000 in margin at a 20 percent commission rate.

This is why distribution strategy matters far more than headline commission percentages. The larger the property and the higher the booking volume, the faster commission leakage compounds—and the more valuable direct booking control becomes over time.

A Different Model for Sustainable Growth

Reducing OTA dependence does not require abandoning existing agencies, CRMs, or media partners. Instead, it requires an overlay strategy aligned with the principles outlined in the Luxury Hospitality Marketing Guide 2026, where owned demand, lifecycle communication, and margin protection drive long-term growth. It requires an overlay strategy that captures demand before it leaks to OTAs, converts interest through owned channels, and retains guests through lifecycle email.

This approach complements traditional marketing while restoring control over revenue, guest data, and brand equity.

Board-Level Takeaway

OTAs will remain part of the distribution landscape. But luxury hotels that allow them to dominate demand generation sacrifice margin, brand equity, and long-term value.

The most resilient luxury properties do not compete on price. They reduce reliance on intermediaries by owning demand, cultivating relationships, and compounding revenue through direct channels — especially email.