Understanding the Structural Limits of Tourism Marketing — and How Demand Ownership Changes the Equation

Most tourism marketing problems are not execution failures — they are structural ones rooted in how demand is created, measured, and retained.

State and regional visitor bureaus are among the most influential demand generators in the travel economy. They fund campaigns, commission research, develop destination narratives, and shape how travelers perceive entire regions long before a booking decision is made.

In many cases, they do this exceptionally well.

Yet despite this effectiveness, most visitor bureaus operate within a structural constraint that quietly limits the long-term impact of their work:

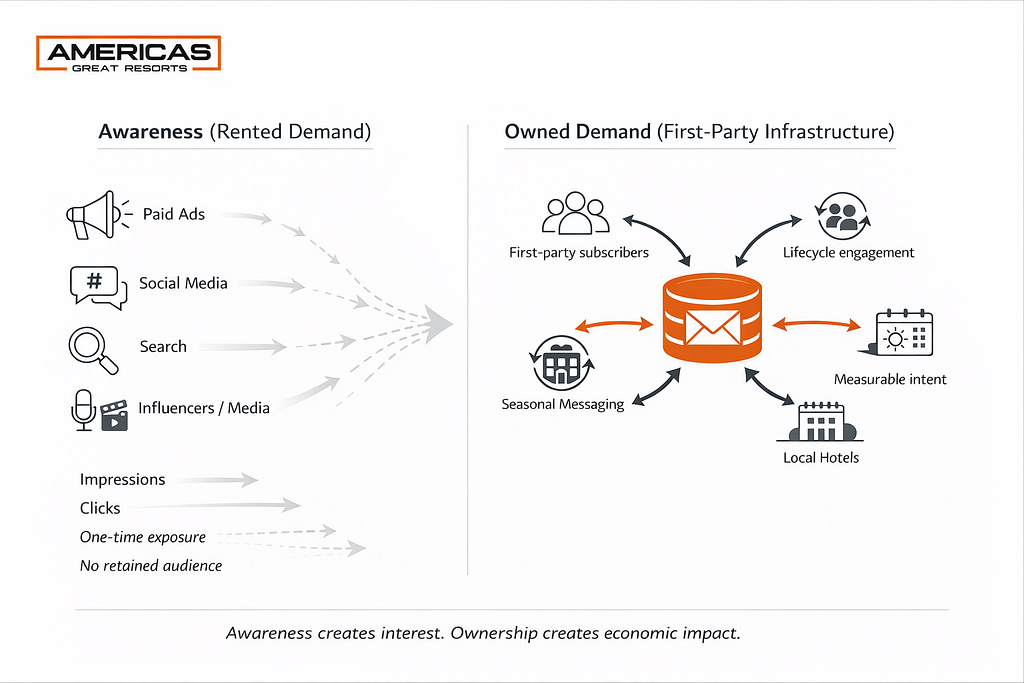

They create demand they do not own. This structural gap mirrors the broader problem explored in guest ownership versus intermediary dependence.

This gap between awareness and ownership is rarely discussed directly in tourism marketing, yet it sits beneath many of the industry’s most persistent challenges — rising acquisition costs, limited attribution, growing reliance on intermediaries, and increasing pressure to justify spend with measurable economic outcomes.

To understand why these challenges persist, and why incremental improvements fail to resolve them, it is necessary to examine how tourism demand is currently created, measured, and distributed.

For a broader framework on how luxury destinations approach marketing strategy today, see Luxury Hotel Marketing.

The Tourism Demand Paradox

Visitor bureaus exist to stimulate visitation, overnight stays, and regional economic activity. To do so, they invest heavily in awareness: advertising, content, media partnerships, events, and digital campaigns designed to place destinations on the traveler’s radar.

The paradox is that while these efforts generate interest, most of that interest flows through channels the bureau does not control or retain.

Paid media impressions disappear once budgets pause.

Social engagement resets with each campaign cycle.

Search traffic arrives anonymously and exits without continuity.

In each case, attention is achieved — but no durable relationship is formed.

From a structural standpoint, this means tourism marketing behaves as a series of disconnected initiatives rather than a cumulative system. Each campaign begins as if no prior demand had ever been generated, regardless of scale or success.

This is not a creative failure. It is an architectural one.

This architectural gap is what Americas Great Resorts defines as Owned Demand Infrastructure (ODI) — an operating framework that enables destinations and hotels to replace rented attention with owned, first-party guest relationships, creating continuity across awareness, engagement, and conversion.

Awareness Is Not Ownership — and the Difference Matters

Awareness is fleeting. Ownership is durable.

When a traveler watches a destination video, clicks an ad, reads an article, or engages with social content, awareness is achieved. But unless that interaction results in a voluntary, first-party connection, the destination has no ability to continue the conversation.

Ownership changes the economics of demand — a distinction explored in detail in luxury hotel guest lifecycle marketing.

When a destination owns demand, it can:

- Re-engage travelers across long planning horizons

- Nurture intent over months rather than moments

- Segment audiences by timing, interests, or readiness

- Observe engagement signals before bookings occur

- Reduce reliance on repeated paid reacquisition

Without ownership, awareness remains shallow. Interest is created, but no institutional memory exists. Each interaction is isolated, unconnected to what came before or after.

For many destinations, this distinction explains why promotional success does not reliably translate into sustained economic outcomes.

Why Tourism Measurement Remains Structurally Limited

Tourism performance is commonly evaluated using lagging or proxy indicators:

- Estimated visitation counts

- Hotel occupancy averages

- Room and tourism tax receipts

- Economic impact models

- Third-party booking data

These metrics are not inherently flawed. They are simply incomplete.

They describe outcomes after demand has converted, but offer little insight into how demand formed, matured, or failed to convert in the first place. This limitation is discussed more directly in The Economics of Guest Lifecycle Marketing for Luxury Resorts.

This limitation persists for structural and political reasons.

Visitor bureaus operate within public or quasi-public accountability frameworks. Reporting tends to favor metrics that are broadly defensible, easy to communicate, and politically neutral. “Visitation increased” is safer than “this campaign influenced booking behavior,” especially when conversion data sits outside bureau control.

As a result, many tourism organizations are forced to infer cause from outcome. They know what happened, but not why.

Without first-party demand ownership, fundamental questions remain unanswered — particularly around attribution, timing, and intent visibility.

- Which campaigns generated genuine travel intent versus casual interest?

- How long did travelers remain engaged before booking elsewhere?

- Which messages influenced timing, seasonality, or length of stay?

- Where did demand stall before conversion occurred?

When demand is anonymous, attribution becomes speculative. When demand is owned, attribution becomes observable.

This distinction matters not only for optimization, but for internal credibility. First-party demand data changes the quality of strategic conversations inside tourism organizations.

Why Paid, Social, and Search Cannot Be Infrastructure

Paid media, social platforms, and search are powerful distribution tools. They are not demand infrastructure.

These channels excel at reach and discovery, but they fail at continuity. Their audiences are controlled by platforms, governed by algorithms, and subject to pricing dynamics outside the destination’s influence.

Critically, they do not create transferable assets.

A social following cannot be moved.

A paid audience disappears when spend stops.

Search visibility resets with algorithm changes.

Even retargeting — often mistaken for ownership — relies on platform persistence rather than destination control, reinforcing why rented demand cannot compound.

Email is different.

Email creates audience memory, not campaign memory. It allows destinations to maintain a persistent, portable, first-party relationship with travelers across time, devices, and planning cycles.

This is why email functions as infrastructure rather than a tactic. It aligns with how tourism demand actually forms: slowly, deliberately, and across multiple touchpoints.

A deeper comparison of these channels is explored in Digital Advertising vs Email Marketing: Where Luxury Hotels Waste Budget — and Where They Win.

Email as Demand Infrastructure in Tourism

Travel decisions—particularly leisure, family, international, and luxury travel — rarely occur in a single session. They unfold over time, influenced by:

- Seasonal considerations

- Budget planning

- Group coordination

- Competitive comparison

- Availability windows

Email supports this reality by allowing destinations to remain present throughout the decision cycle without paying repeatedly for reacquisition.

When deployed strategically, email enables destinations to:

- Capture intent at the moment of inspiration

- Maintain relevance during extended planning phases

- Reactivate interest seasonally or annually

- Segment travelers by behavior and readiness

- Build cumulative engagement rather than isolated interactions

This is why many visitor bureaus are exploring structured email programs as a way to extend the lifespan and impact of their marketing investments. For a tactical discussion of execution, see How State Visitor Bureaus Can Leverage Email Marketing.

The Structural Disconnect Between Visitor Bureaus and Hotels

Visitor bureaus and hotels ultimately pursue the same outcome: increased visitation and economic activity. Structurally, however, their responsibilities are divided.

Visitor bureaus fund inspiration and awareness.

Hotels fund conversion and revenue generation.

Online travel agencies frequently sit between them, extracting value from both.

This division is reinforced by governance and political reality.

Visitor bureaus must maintain neutrality. They cannot appear to favor specific properties, pricing models, or commercial outcomes. Hotels, meanwhile, must compete for demand using whatever tools they can afford.

Large brands often invest in internal marketing teams and advanced technology, while independent and boutique hotels face very different marketing constraints. Smaller and boutique hotels frequently cannot. For them, intermediaries become the default — not because they are optimal, but because they are accessible.

The result is systemic inefficiency:

- Hotels compete individually for demand created collectively

- Visitor bureaus generate interest they cannot meaningfully distribute

- Intermediaries absorb a disproportionate share of economic value

This disconnect is not the result of misalignment or unwillingness. It is structural — and therefore persistent. This structural tension is one reason many destinations are rethinking how they partner with hotels and marketing agencies.

Why Traditional Co-Op Marketing Falls Short

Many destinations have attempted to bridge this gap through co-op marketing programs. While well-intentioned, most focus on shared spend rather than shared demand.

Common limitations include:

- Short-term campaign alignment without continuity

- Exposure without first-party ownership

- Equal visibility without lifecycle nurturing

- Measurement focused on impressions rather than intent

In practice, these programs replicate the same awareness problem at a smaller scale — visibility without long-term demand ownership. They distribute exposure, but fail to create durable demand assets that persist beyond individual campaigns.

What is missing is an ownership layer that compounds over time.

Shared Demand Infrastructure: A Structural Alternative

A different model is possible.

Rather than treating demand creation and demand conversion as separate responsibilities, destinations can adopt a shared demand infrastructure — one that captures traveler interest at the destination level and distributes value regionally over time.

In this framework:

- The visitor bureau supports or sponsors the demand layer

- First-party email audiences are built around destination intent

- Opt-in capture occurs through guides, itineraries, planning tools, and content

- Lifecycle campaigns mature interest toward booking readiness

- Participating hotels gain access to qualified, lower-cost demand

- The bureau gains visibility into engagement and economic signals

Crucially, the bureau does not sell rooms, operate a booking platform, or endorse specific properties.

Hotels participate through transparent opt-in frameworks. Demand is distributed through structure, not favoritism. Governance is preserved while outcomes improve.

How Demand Ownership Changes the Economics

When destinations own demand rather than rent attention, several structural shifts occur.

Campaigns compound rather than reset.

Each initiative builds on an existing audience base.

Acquisition costs decline over time.

Owned audiences reduce dependence on repeated paid exposure and intermediary fees.

Hotels gain access to qualified demand.

Particularly meaningful for smaller properties with limited budgets.

Attribution improves earlier in the decision cycle.

Engagement signals appear before bookings occur.

Economic impact becomes more defensible.

Outcomes can be tied to observable traveler behavior rather than modeled assumptions.

These shifts do not replace traditional tourism marketing. They extend it by adding continuity, accountability, and efficiency.

A Proven Model in Practice

This approach is not theoretical.

Americas Great Resorts has executed cooperative email demand initiatives in partnership with visitor bureaus, including a long-standing collaboration with the Hawaii Visitors and Convention Bureau. That program demonstrated how destination-level email demand, combined with hotel participation, can drive sustained engagement while supporting broader tourism objectives.

Details of that collaboration are outlined in Elevating Hospitality: Americas Great Resorts and the Hawaii Visitors and Convention Bureau Forge a Luxury Co-Op Email Marketing Initiative.

Why This Matters Now

Tourism marketing is becoming more expensive, more fragmented, and more difficult to measure. At the same time, destinations face increasing pressure to justify spend, reduce intermediary dependence, and demonstrate measurable economic outcomes.

In this environment, demand ownership becomes a competitive advantage.

Visitor bureaus that invest in first-party demand infrastructure position themselves not only as promoters, but as economic enablers — supporting local hotels, improving attribution, and building systems that scale over time.

From Promotion to Architecture

Tourism has long excelled at promotion. The next phase of growth lies in architecture — building systems that allow demand to accumulate, mature, and convert.

When destinations own demand, they move beyond awareness toward sustainability, accountability, and measurable impact through owned, first-party marketing systems.

This is not a departure from tourism marketing.

It is its natural evolution.