For many luxury hotels, third-party email marketing still carries emotional baggage.

It brings back memories of the late 1990s and early 2000s — indiscriminate blasts, questionable lists, brand damage, and inbox fatigue. Back then, email was cheap, uncontrolled, and largely unaccountable. Hotels were right to walk away.

But here’s what never gets discussed.

Hotels didn’t refine outbound acquisition.

They abandoned it.

And in that vacuum, online travel platforms quietly took control of demand.

This article explains how that happened — and why modern third-party email, when executed correctly, now represents one of the most powerful ways luxury properties can reclaim guest ownership and reduce OTA dependence.

The Spam Era — Why the Fear Was Rational

Early email marketing earned its reputation for a reason. It relied on random purchased lists, mass broadcasting, zero targeting, and no meaningful consent frameworks. There were no deliverability standards, no brand protection, and no attribution.

That wasn’t marketing.

That was noise.

Luxury hotels stepped away to protect their brands — a reasonable decision at the time.

But instead of replacing crude outbound tactics with something more sophisticated, the industry largely exited upstream acquisition altogether. Hotels preserved retention systems, CRM platforms, and loyalty programs — but they stopped actively creating owned demand.

While Hotels Pulled Back, OTAs Moved In

As hotels retreated from outbound guest acquisition, third-party platforms did the opposite. They invested billions into search visibility, traveler identity databases, behavioral targeting, remarketing infrastructure, and intent modeling.

Over time, these platforms became the default discovery engine for luxury travel.

This shift was structural — even if its impact unfolded over time.

Hotels no longer controlled how guests found them. They received transactions. Platforms owned relationships.

That distinction still defines today’s hospitality economics.

The Modern Contradiction No One Confronts

Luxury hotels now accept something extraordinary as normal business practice.

They willingly pay 18–25% commissions to platforms to introduce guests they will never truly own.

These are guests whose discovery and remarketing are controlled by the platform, who default back to OTA channels on their next trip, and who rarely become part of a hotel’s upstream audience — even if they appear in the hotel’s PMS after the stay.

Yet many of these same properties hesitate to use third-party email introductions because of something that happened in 1999 — even though those guests would book direct, enter the hotel’s CRM, become owned identities, generate repeat stays, and create lifetime value.

The contradiction isn’t cost. It’s ownership blindness.

Hotels are comfortable paying to lose guests — but afraid to introduce guests they would own for life.

This Is Not an Email Marketing Question

This is a demand control problem.

Luxury hospitality growth follows a structural path: Discovery → Consideration → Intent → Transaction → Relationship.

Most hotels today only control the last two stages. Discovery and intent largely sit with platforms.

CRM systems operate downstream. Lifecycle programs activate existing guests. They cannot reclaim discovery that already belongs to someone else.

Email does not create a traveler’s desire to travel. It converts general travel intent into specific property intent — directing existing interest toward a particular hotel once audience access exists.

Owned Demand Infrastructure provides audience access. Email is simply the delivery mechanism that activates that access.

The asset is not email. The asset is audience access.

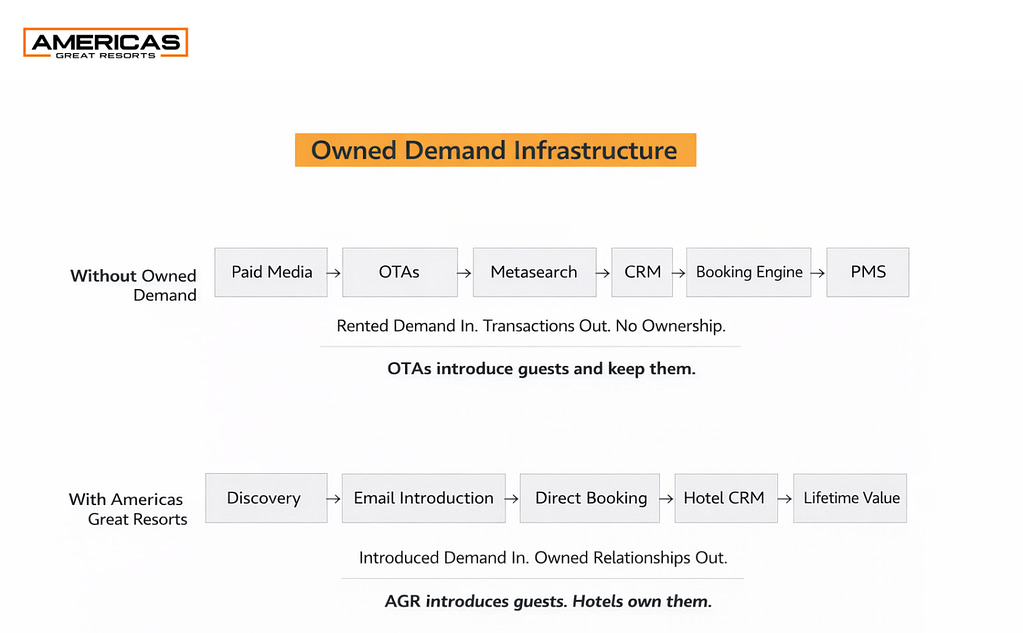

Owned Demand Infrastructure — OTAs introduce guests and keep them. AGR introduces guests. Hotels own them.

If a hotel does not control upstream audience access, no amount of personalization, automation, or lifecycle optimization can fix it. That’s why direct bookings stall even when marketing activity looks busy.

The Critical Difference — Introduction vs Ownership

Platform model: Discovery → Booking → Guest → Platform keeps the relationship.

Owned Demand Infrastructure works differently: Discovery → Introduction → Hotel owns the relationship.

Owned Demand Infrastructure is a permission-based discovery system built on opt-in frequent traveler audiences and active destination discovery behavior.

This architecture is formally defined in Americas Great Resorts (AGR) system framework: The System — Owned Demand Infrastructure

Owned Demand Infrastructure is the operating model. AGR is the operator of that model.

Platforms introduce guests and keep them. Owned demand introduces guests and gives them back.

Those guests become assets — not transactions. They enter the hotel’s CRM, receive pre-arrival communication, return for future stays, recommend the property, and build lifetime value.

This is not a campaign tactic. It is an upstream access layer designed to restore control of discovery.

Old World Email vs Modern Demand Introduction

What hotels still fear is legacy spam — indiscriminate blasting, brand dilution, low-quality traffic, and compliance risk.

Modern third-party email operates very differently. At its core, it relies on:

- Permission-based discovery audiences

- Verified frequent luxury travelers

- Behavioral intent signals tied to real travel activity

- Brand-aligned creative and controlled frequency

- Deliverability reputation management and transparent attribution

- Direct CRM handoff once a booking occurs

These are not generic travel lists. They are curated discovery audiences built from opt-in travelers who have demonstrated high-end travel behavior — recent luxury stays, destination engagement, and active interest in discovering new resorts.

Spam interrupts people who don’t care. Owned demand introduces travelers who already do.

Ownership applies at conversion. Once a traveler books, the guest becomes fully owned by the hotel inside its CRM and lifecycle systems. For travelers who do not book immediately, Owned Demand Infrastructure preserves repeat access within AGR’s permission-based discovery environment — allowing hotels to continue introducing their brand to qualified prospects without transferring identity or consent until booking occurs.

In practice, hotels implementing owned demand typically see measurable shifts in channel mix over time, as direct guest volume compounds and reliance on platforms gradually decreases.

Once a traveler books, the relationship moves entirely onto the hotel’s own systems. Because the booking occurs directly on the hotel’s website, the property receives the full, unmasked guest profile immediately — not a proxy identity controlled by an intermediary. The guest enters the property’s CRM through standard booking consent flows. AGR does not manage pre-arrival, post-stay, or lifecycle communication. Those are owned and executed by the hotel.

AGR operates the upstream introduction and identity capture layer. The hotel retains full ownership of booking, CRM, lifecycle engagement, and the guest relationship.

AGR introduces the guest. The hotel builds the relationship.

Why This Matters More Than Commission Rates

Most executives frame OTA commissions as a cost of sale. That’s incomplete.

The real cost is customer equity loss. Every platform-introduced guest is a non-compounding customer. You don’t build owned audience, repeat behavior, direct loyalty, or long-term value. You rent demand — then rent it again.

Unlike OTAs, where commission is paid on every stay forever, owned demand compounds. One introduced traveler can generate multiple future stays without re-paying a third-party introduction or commission fee.

Compliance, Permission, and Guest Trust

All introductions occur through permission-based audiences with established opt-in frameworks and deliverability governance. Discovery happens first; brand consent happens at booking.

Not every introduced traveler books immediately — but when a booking occurs, the guest enters the hotel’s own booking engine and CRM, enabling unrestricted lifecycle engagement by the property.

What This Looks Like in Practice

Owned Demand Infrastructure is not a black box.

In practical terms, it includes audience integrity through opt-in luxury travel discovery ecosystems, brand control through hotel-approved creative standards, introduction and handoff via curated email discovery and direct booking, measurement through direct attribution and incrementality analysis, and risk management through creative approval workflows and deliverability monitoring.

This is not a replacement for paid search, metasearch, or loyalty. It is a complementary upstream audience access layer designed to restore owned discovery — so downstream systems can finally compound value.

For hotels evaluating execution mechanics, AGR’s operating model is outlined here: Email Marketing for Hotels — Complete Guide

The Realization

Luxury hotels didn’t abandon spam. They abandoned acquisition. And then paid platforms to keep their customers.

Modern third-party email — executed with permission, targeting, brand controls, and audience integrity — is not a relic of the past. It is the primary delivery rail used to activate Owned Demand Infrastructure.

Reclaiming guest relationships starts before the booking. Everything else is downstream optimization.