Luxury Hospitality Has Confused Experience With Ownership

Luxury hospitality has always believed it was in the business of experience.

In reality, it has always been in the business of relationships.

For decades, that distinction felt academic. Demand was strong. Distribution was limited. Loyalty was assumed to follow excellence. If a guest enjoyed their stay, they would return. If they didn’t, another guest would take their place.

That world no longer exists.

Today’s luxury hotel market does not reward assumption or momentum. It rewards control. And control begins with ownership.

The uncomfortable truth is this: luxury hotels that do not own their guest relationships are not building a future. They are renting one.

Why don’t luxury hotels truly own their guest relationships?

Luxury hotels often don’t own their guest relationships because demand is intermediated through OTAs, paid platforms, and third-party systems that control discovery, data, and repeat engagement.

While hotels deliver the on-property experience, the guest relationship is frequently captured upstream by platforms that retain the booking data, behavioral signals, and re-marketing access. Without a first-party acquisition and lifecycle strategy, hotels remain dependent on rented demand — limiting loyalty, margin control, and long-term revenue growth.

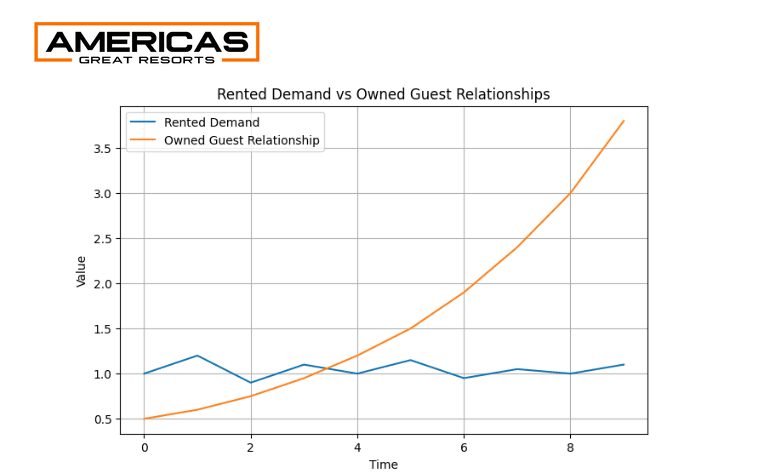

Rented demand plateaus over time, while owned guest relationships compound in value.

The Core Problem: A Booking Is Not a Relationship

A booking is not a relationship.

It is a transaction.

Transactions can repeat, but they do not compound. They do not accumulate memory. They do not create preference or loyalty on their own. They simply occur again, often at a higher cost.

Many luxury hotels mistake full rooms for progress. Occupancy looks strong. ADR holds. Revenue reports remain healthy. But surface performance often hides structural weakness. When bookings arrive primarily through intermediaries — OTAs, paid media, metasearch platforms, or brand-controlled channels — the hotel is not strengthening its position. It is borrowing demand.

Each stay concludes without a durable connection that persists beyond checkout. Each future booking must be reacquired.

This is why Guest Lifecycle Marketing for Luxury Resorts frames relationship ownership as a compounding economic asset rather than a marketing tactic. Without ownership, every booking resets the clock back to zero.

To see what “ownership infrastructure” looks like in practice, read our complete guide to email marketing for hotels, which breaks down how segmentation, cadence, and lifecycle timing turn guest data into compounding direct bookings.

Ownership vs. Dependence: Why the Economics Break

Ownership creates leverage.

Renting creates dependence.

A hotel that does not control its guest data, its communication channel, or its ability to re-engage is forced into a reactive posture. It must wait to be rediscovered. It must compete to be selected again. It must repurchase visibility that once belonged to it.

Over time, a predictable pattern emerges. Acquisition costs rise. Loyalty weakens. Repeat behavior becomes inconsistent. Marketing spend grows without a proportional increase in lifetime value.

The hotel may appear successful, but its future bookings are being financed one stay at a time.

This is not a failure of execution.

It is a failure of ownership economics.

Hotels that own their guest relationships operate under a fundamentally different model.

Ownership allows memory to persist across stays. Preferences accumulate. Communication becomes contextual instead of promotional. Revenue shifts from acquisition-driven to lifecycle-driven.

In this model, the cost of the next booking declines rather than increases. The value of each guest grows instead of resetting. Demand becomes something the hotel creates rather than something it constantly chases.

This compounding effect only becomes visible when a property establishes a deliberate, sustained communication rhythm — one that treats guest communication as long-term infrastructure rather than a series of disconnected campaigns.

Without ownership, compounding never begins.

Why This Is Getting Worse in 2026

The problem is accelerating.

Modern luxury travelers are not loyal by default. They are informed, mobile, and overwhelmed by choice. They do not remember brands that do not remember them.

At the same time, distribution platforms are becoming more competitive, more expensive, and more opaque. Their incentives optimize for conversion, not for your long-term guest value. Visibility must be repurchased. Preference must be re-earned. Loyalty must be incentivized rather than remembered.

As these systems mature, hotels that rely on them exclusively enter a cycle where relationships must be reacquired, margins compress under rising acquisition costs, and growth becomes increasingly fragile.

The economic divergence between rented demand and owned demand is examined directly in Digital Advertising vs. Email Marketing for Hotels, where short-term efficiency gives way to long-term dependency.

The Split: Hotels That Compound vs. Hotels That Reset

An invisible divide is forming in luxury hospitality.

On one side are hotels that own their guest relationships. They know who their guests are, how they behave, why they return, and how to speak to them over time. Their marketing compounds. Their margins stabilize. Their reliance on third parties declines.

On the other side are hotels that depend on rediscovery. Their marketing resets every season. Their growth requires constant spend. Their future bookings are never fully theirs.

The Conclusion: Ownership Is the Strategy

This is not about channels.

It is not about tactics.

It is not even about email.

It is about ownership.

This is the same strategic foundation behind modern luxury hotel marketing: durable growth comes from controlling the relationship, not renting attention one booking at a time.

Luxury hotels that do not own their guest relationships are not failing — yet. But they are making a trade that becomes harder to reverse with every unowned booking. Each season of rented demand increases dependence. Each missed opportunity to establish ownership makes independence more expensive.

Eventually, the cost of not owning becomes visible.

By then, the future has already been rented out.

For luxury properties that want to reclaim that ownership without expanding internal complexity, Americas Great Resorts’ hospitality email marketing agency work is designed specifically to convert rented demand into owned, compounding guest relationships.