AI Is Compressing Discovery — Ownership Determines Margin

Leave email to CRM teams long enough, and something predictable happens.

It becomes downstream.

Transactional.

Reactive.

A retention tool asked to compensate for demand hotels no longer control.

Meanwhile, discovery quietly moved upstream.

First to search engines.

Then to metasearch.

Now increasingly to AI.

And with that shift, hotels didn’t just abandon email for new customer acquisition — they abandoned ownership of the introduction.

They replaced it with spray-and-pray tactics.

Noisy. Untargeted. Transactional.

Everyone blasting offers to rented audiences, hoping something would stick.

Acquisition became rented.

Relationships became downstream.

CRM was left trying to compensate for demand hotels no longer controlled.

The smart hotels used email for new customer acquisition to own the guest from the very first interaction.

Most stopped.

And that’s how OTAs walked in through the front door.

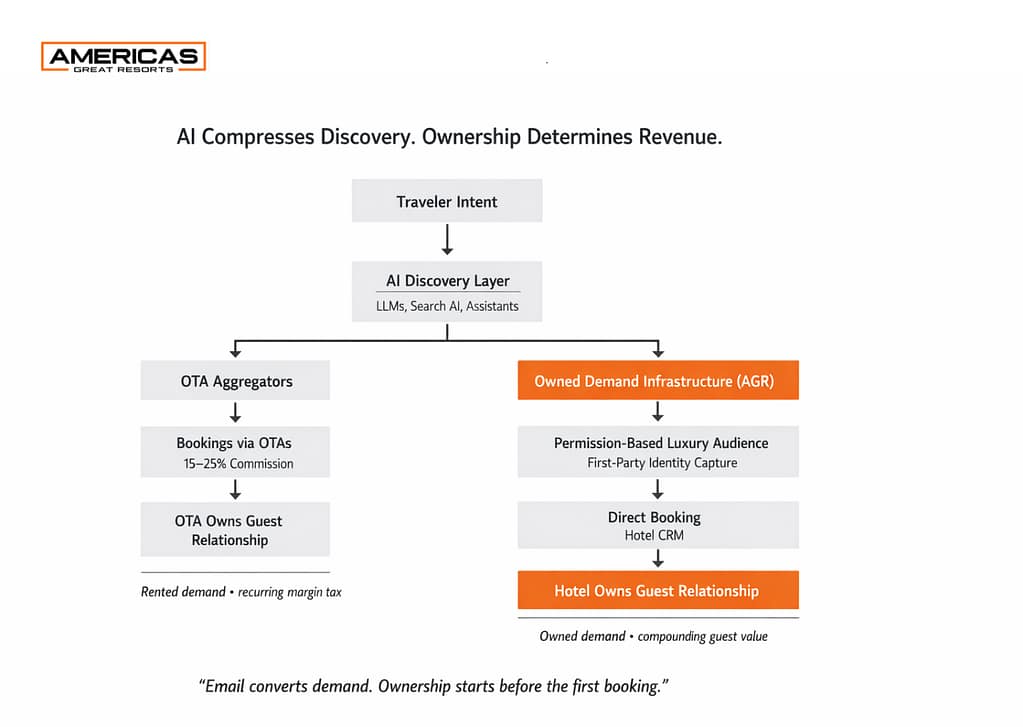

AI Is Compressing Hotel Discovery — And OTAs Are Structurally Positioned to Benefit

AI isn’t eliminating browsing overnight.

But it is compressing the journey.

Instead of ten tabs, travelers increasingly get one synthesized answer.

Instead of exploring dozens of hotel sites, AI presents a short list of “best options.”

That matters because AI systems favor structured, aggregated, machine-readable inventory.

OTAs already operate that way.

Hotels, for the most part, don’t.

So AI doesn’t “prefer” OTAs.

It simply sees them more clearly.

Which means unless hotels actively change how they introduce themselves to travelers, AI will increasingly route demand toward the platforms that already control inventory, pricing, reviews, and instant booking.

Not because OTAs are smarter marketers.

Because they’re architecturally easier for machines to understand.

This isn’t a marketing evolution.

It’s a control shift.

And control now begins upstream — at the moment of introduction.

AI compresses discovery into fewer decisions. Ownership of the introduction determines who owns the guest — and who keeps the margin.

Email Converts Demand. It Does Not Create Demand.

This distinction matters.

Email, CRM, loyalty, and lifecycle systems are conversion and retention engines.

They organize demand.

They nurture relationships.

They increase lifetime value.

They do not generate first contact.

When hotels treat email purely as a downstream channel, they surrender acquisition to third parties — OTAs, paid marketplaces, and now AI-mediated discovery layers.

And once that happens, every booking carries a structural tax.

You don’t just pay commission.

You lose the guest.

OTAs introduce travelers and keep them.

Hotels inherit bookings without ownership.

That’s the quiet economics behind stagnant direct share.

What “Acquisition Email” Actually Means

Acquisition email isn’t blasting strangers.

It’s introducing new, permission-based luxury travelers directly into a hotel’s ecosystem before marketplaces do.

Americas Great Resorts accesses opt-in, high-net-worth travel audiences, promotes specific luxury properties, captures first-party identity and consent, then routes those travelers into structured email journeys that drive direct bookings and long-term CRM ownership.

From that point forward, the hotel controls the relationship: lifecycle messaging, repeat stays, personalization, and lifetime value.

This is not anonymous clicks.

This is first-party guest ownership, created at the moment of introduction.

That system — capturing identity upstream and converting downstream — is what we call Owned Demand Infrastructure.

It doesn’t replace CRM.

It feeds it.

The Economics Most Hotels Never Model

Let’s ground this in real numbers.

Consider a 200-room luxury hotel:

- 70% average occupancy

- $850 ADR

- Annual room revenue: ~$43.4M

If 40% of bookings come via OTAs at a conservative 20% commission:

That’s roughly $3.47M per year in distribution fees.

Now imagine shifting just 5 percentage points of bookings from OTA to direct in Year One.

That’s about $2.15M in revenue moving back into owned channels.

At 20% avoided commission, that’s roughly $430,000 in recovered margin.

Even after assuming $100 per booking in acquisition costs, the hotel retains approximately $300,000 in incremental contribution.

Now extend that to Year Three with a 10-point shift.

That becomes roughly $860,000 annually in recovered margin.

Not from higher ADR.

Not from more rooms.

Not from heavier discounting.

Just from owning the introduction.

Important: this scenario is illustrative, based on typical luxury ADR, occupancy, and OTA commission ranges.

That’s why ownership matters.

Revenue follows control.

About Americas Great Resorts

Americas Great Resorts helps luxury hotels build Owned Demand Infrastructure — introducing permission-based luxury travelers directly into hotel ecosystems so properties own guest relationships from first contact through lifetime value.

We don’t replace CRM.

We make it matter.