The Structural Misdiagnosis Behind Luxury Hotel Demand Generation

Luxury hotel demand generation is often misunderstood — especially when email marketing is expected to create demand instead of convert it. When luxury hotels miss booking targets, the post-mortem tends to sound the same.

Email isn’t performing.

The CRM isn’t driving enough revenue.

The database isn’t engaging.

The automations need work.

The creative needs to be refreshed.

That diagnosis is intuitively appealing because it points to something the hotel can control: a platform, a vendor, a workflow, a campaign calendar.

But it is usually wrong.

Luxury hotels do not have an email problem. They have a demand problem — specifically, a demand ownership problem.

We define the solution layer as Owned Demand Infrastructure (ODI) — the structural system that determines whether a hotel controls demand introduction before intermediaries, algorithms, and marketplaces shape the buying environment. ODI is not a replacement for email or CRM. It is the upstream layer that makes those downstream systems perform the role they were designed to play.

Email and CRM systems are downstream instruments. They can improve conversion, retention, and lifetime value once demand exists. They cannot solve the upstream economic reality that determines whether demand arrives in the first place, who controls it, and what conditions come attached to it.

The most important variable in modern luxury hospitality growth is not whether your lifecycle journeys are optimized. It is whether your hotel owns access to qualified travelers before intermediaries and auctions dictate the buying environment.

Until that is understood, teams will continue to optimize conversion systems while demand control keeps drifting away — and the organization will keep blaming the wrong thing.

Why This Keeps Happening: Hospitality Confuses Optimization With Growth

In most industries, it is obvious that “growth” and “optimization” are different.

In luxury hospitality, the distinction is persistently blurred because the industry’s tools, reporting, and organizational incentives encourage it.

Optimization is the improvement of performance inside an existing system. It assumes the system is correct and tries to raise efficiency within it.

Growth requires changing the system that produces the outcomes.

Luxury hotels keep trying to grow through optimization because optimization is what their tool stack can see:

- email metrics

- CRM attribution

- website engagement

- retargeting performance

- channel ROI dashboards

Those numbers are measurable, reportable, and actionable. They also create a false sense of causality: if bookings are down, the levers you can pull must be the levers that matter.

But upstream demand ownership is not visible in most dashboards. It is structural. It shows up indirectly as:

- rising OTA share even when marketing spend increases

- increasing acquisition costs for the same volume

- direct booking volatility that can’t be “fixed” with better creative

- margin compression despite “better marketing”

- diminishing returns from additional paid investment

When those symptoms appear, hotels often conclude the CRM or email program is failing — when in reality the upstream system that supplies demand is constraining everything downstream.

A Useful Mental Model: Two Different Systems, Two Different Physics

Luxury hotel marketing is not one system. It is two systems that operate at different points in time and follow different economics.

System 1: Demand Introduction (Pre-CRM)

This is the system that determines whether qualified new-to-brand travelers discover the hotel in the first place.

Its questions are upstream:

- Who sees you before they are “shopping”?

- Who controls first touch?

- Who frames your value proposition?

- Are you introduced on your terms or inside a marketplace?

System 2: Lifecycle Conversion (Post-CRM)

This is the system that increases revenue after a guest is known, booked, or otherwise in the database.

Its questions are downstream:

- Do they book direct?

- Do they return?

- Do they upgrade?

- Does lifetime value compound?

Most luxury hotels invest heavily in System 2 because it is what hospitality CRMs are built to do.

That’s appropriate — but it becomes dangerous when System 2 is expected to compensate for a failure in System 1.

To be clear: lifecycle email is a powerful conversion and compounding engine. This distinction — and why it causes so many luxury hotel marketing strategies to fail — is explored in detail in Why Luxury Hotel Marketing Fails (and Why Email Can’t Fix It). But it can only convert what already exists. For the complete foundation on how lifecycle email works when it is correctly positioned, see Email Marketing for Hotels: A Complete Guide to Increase Bookings & Revenue.

The Economic Mechanism: When Demand Is Rented, Control Declines and Costs Rise

The defining feature of the current hotel demand ecosystem is that much of it is rented.

Rented demand is not merely “paid.” It is demand where:

- visibility is controlled by another entity

- access can be throttled or repriced

- positioning is constrained by the platform’s format

- competitors are displayed beside you by default

- the platform captures the relationship advantage

OTAs are the obvious example, but the same logic applies to paid auctions and many platform-driven discovery environments.

In a rented demand environment, the hotel experiences three compounding effects:

1) Pricing Power Erodes

Luxury relies on perceived differentiation. Marketplaces and auctions compress differentiation into comparable units: listings, rates, reviews, and filters.

The more demand is intermediated, the more the purchase decision is forced into a comparative frame — which increases price sensitivity even for luxury products.

2) Acquisition Costs Inflate Over Time

Rented demand behaves like a tax because it is structurally bid up. As more hotels compete for the same pool of attention, the marginal cost of acquiring the next booking rises.

This is why “doing more of what worked last year” becomes less effective — even if execution improves.

3) Relationship Ownership Shifts Away From the Hotel

The first interaction matters. Whoever owns first touch shapes the relationship. If discovery happens inside an OTA ecosystem, the relationship begins rented. If discovery happens through a paid auction, the relationship begins rented. In both cases, the hotel is paying to access the traveler in an environment it does not control.

This is why OTA dependence tends to persist even when hotels invest heavily in conversion optimization. They are improving performance inside a system where the upstream relationship is not owned.

Why OTAs Continue to Win: They Control the Buying Environment

Hotels often talk about OTAs as if the problem is commission percentage.

The deeper problem is not commission — it is who controls the buying environment.

OTAs sit upstream of choice. They decide:

- which properties appear

- in what order

- beside which competitors

- with which framing signals (price, scarcity, urgency, comparisons)

Once a traveler enters that environment, the hotel is no longer selling its experience on its own terms. It is competing inside a marketplace designed to maximize marketplace outcomes.

At that point, lifecycle email is irrelevant to the initial decision. It can optimize repeat behavior later, but it cannot retroactively change how the traveler discovered the brand or why they chose it.

This is why reducing OTA dependence is not primarily a “marketing channel mix” problem. It is a demand ownership problem.

Why CRM and Email Get Blamed Anyway: Organizations Optimize What They Can See

If this is structural, why do smart hotel teams keep misdiagnosing it?

Because the organizational measurement system is built to reward downstream optimization.

When you can measure opens, clicks, segmentation, attributed revenue, and automation performance, those become the levers leadership expects to move outcomes.

When you cannot easily measure demand ownership — because it is distributed across discovery environments — it gets ignored.

This creates a predictable blame pattern:

- bookings soften

- upstream demand becomes more expensive or more intermediated

- downstream conversion cannot overcome the constraint

- leadership sees CRM metrics and assumes that’s where the failure is

- email strategy gets “fixed”

- the upstream constraint remains

- performance remains constrained

The organization concludes the “fix” didn’t work and repeats the cycle.

The Missing Layer: A Pre-CRM Demand Introduction System

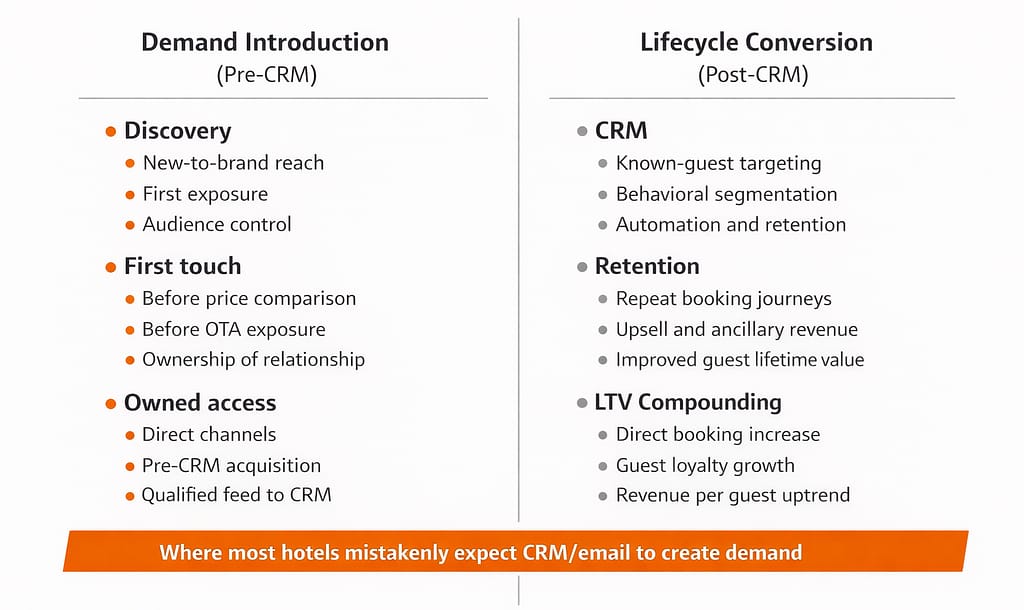

To understand why email and CRM are so often misused in luxury hospitality, it helps to separate marketing into two distinct systems that operate at different points in time. One system creates demand. The other converts it. Most hotels treat these as the same function — and that misunderstanding is where performance breakdowns begin.

Demand introduction occurs before CRM and creates awareness, access, and ownership. Lifecycle conversion begins only after a guest is known — yet many hotels mistakenly expect CRM and email to generate demand.

The left side of this model represents demand introduction — the point at which a traveler first encounters a brand, forms awareness, and enters the consideration set. This occurs before pricing, OTAs, or comparison shopping.

The right side represents lifecycle conversion — what happens after a traveler is already known: CRM communication, retention efforts, loyalty, and lifetime value optimization.

The structural mistake most hotels make is expecting the right side of this model to perform the function of the left. When CRM and email are asked to generate demand rather than convert it, performance inevitably plateaus — not because the tools are ineffective, but because they are being used outside their designed role.

Luxury hotels that break the cycle do not do it by replacing their CRM.

They do it by adding a missing layer: a system that introduces the hotel to qualified new-to-brand travelers before intermediaries and auctions define the choice environment.

This is what changes the economics.

When demand is introduced upstream, on controlled terms, the downstream systems finally behave like they are supposed to:

- CRM performance improves because the feed is healthier

- direct bookings become less volatile

- price pressure declines because the relationship begins earlier

- loyalty and LTV compound because the relationship begins owned

This is the same logic behind why guest ownership is a prerequisite for compounding value over time. If you want the deeper economic treatment of that concept, see Luxury Hotels Can’t Compound Revenue Without Guest Ownership.

Why This Matters More in 2026: AI and Platforms Compress Discovery

Luxury hospitality is entering a discovery environment that is more consolidated and more algorithmic than at any point in the industry’s modern history.

- platforms continue to consolidate attention

- auctions continue to reprice upward

- organic visibility becomes less predictable

- AI-mediated discovery compresses choice sets

In that environment, “better optimization” is not a strategy. It is table stakes.

The strategic advantage is structural: controlling demand introduction so that the relationship begins on owned terms rather than rented terms.

The Bottom Line

Luxury hotels don’t have an email problem.

They have a demand problem.

Email and CRM platforms are downstream systems. They are designed to maximize the value of demand once it exists. They cannot solve the upstream economic reality that determines who controls discovery, what the hotel pays to be seen, and whether the relationship begins owned or rented.

If a luxury hotel wants to reduce long-term reliance on OTAs, the question is not “How do we improve email performance?”

The question is:

Where does demand originate — and who controls it before the guest ever enters our database?

Solve that, and email starts working the way it always promised it would.

Final Thought: Why Demand Ownership Determines Everything

Luxury hotels do not struggle because their marketing teams are underperforming.

They struggle because the industry has spent years optimizing the wrong layer of the system.

Email performance, CRM automation, campaign cadence, segmentation, attribution — all of these exist after demand has already been created. They assume the hard part has been solved.

It has not.

The defining advantage in modern hospitality is not creative, technology, or even budget. It is control over demand introduction — the ability to reach qualified travelers before intermediaries, algorithms, and marketplaces shape the decision.

When that control is lost, everything downstream becomes reactive:

- pricing pressure increases

- margins compress

- loyalty weakens

- OTA reliance grows

- marketing teams chase performance instead of building leverage

This is why so many luxury hotels feel like they are doing “everything right” and still falling behind.

They are optimizing inside a system they do not own.

The solution is not more tools.

The solution is not better automation.

The solution is not another CRM upgrade.

The solution is structural.

Until demand is owned, every other improvement will have a ceiling.

That is the difference between growth and maintenance.

And that is why luxury hotels do not have an email problem.

They have a demand problem.

FAQ: Demand, Email, and Growth in Luxury Hospitality

Why doesn’t better email marketing fix declining direct bookings?

Because email operates after demand already exists. It can improve conversion, retention, and lifetime value, but it cannot introduce a hotel to new travelers who have never encountered the brand. When demand is weak or intermediated, email performance will always appear constrained.

What does “demand ownership” actually mean?

Demand ownership means controlling how travelers first encounter your hotel — not relying on OTAs, paid auctions, or third-party platforms to introduce your brand. It is the difference between owning the relationship and renting access to it.

Why do OTAs continue to gain power even when hotels invest more in marketing?

Because OTAs control discovery. They sit upstream of choice and frame the decision environment. When discovery happens inside an OTA, the hotel is competing on terms set by the platform, not by the brand.

Isn’t SEO supposed to solve this problem?

SEO can help, but it is not a complete solution. Search visibility is increasingly shaped by algorithms, competition, and AI-generated summaries. It does not guarantee demand ownership or protect against platform dependency.

Can lifecycle email reduce OTA dependence?

Only after demand is owned. Lifecycle email is extremely effective at maximizing value from known guests, but it cannot create awareness or replace demand-generation channels.

What is the biggest mistake luxury hotels make with marketing strategy?

Confusing optimization with growth. Improving performance inside rented systems feels productive, but it does not change who controls demand. Without ownership, growth will always be fragile.

What should luxury hotels focus on instead?

They should focus on how demand is introduced — not just how it is converted. Hotels that control first touch, audience access, and relationship entry points gain pricing power, stability, and long-term growth leverage.